The “Massachusetts Millionaires Tax” has been widely publicized. In contrast, the long-delayed state level charitable deduction for Massachusetts taxpayers has received far less notice. Let’s look at both to see how these changes could create opportunities for you to support Massachusetts General Hospital.

The “Massachusetts Millionaires Tax”

With the “Massachusetts Millionaires Tax,” taxpayers with taxable income over $1 million, are subject to an additional 4% surtax. Starting in 2023, this means that the Massachusetts personal income tax “floor” of 5% effectively rises to 9% on all taxable income, for those above the $1 million threshold.

Though estimates consistently show the “Millionaires Tax” will impact fewer than 1% of Massachusetts taxpayers, this will be cold comfort to anyone selling a home or business, lifting their income above the $1 million threshold.

Avoiding the “Millionaires Tax”

There are several options to help a taxpayer avoid the “Millionaires Tax.” First, it may be possible to spread the receipt of taxable income over multiple years, allowing the taxpayer to remain below the $1 million threshold in any one year. Second, married couples may choose to file separate tax returns — rather than jointly — so that each person can take full advantage of the $1 million threshold.

Even better, now that the long-delayed Massachusetts state charitable income deduction is in force, donors large and small may see two sets of tax savings from their charitable gifts. With careful planning, this state level deduction combined with the federal, is a powerful one, two punch.

Unlike the federal income tax charitable deduction which is available only to those who itemize their deductions, the great news, for donors of any amount, is that the Massachusetts charitable deduction is available to everyone. It doesn’t matter whether the taxpayer itemizes deductions on their federal tax return or not.

You Make a Difference

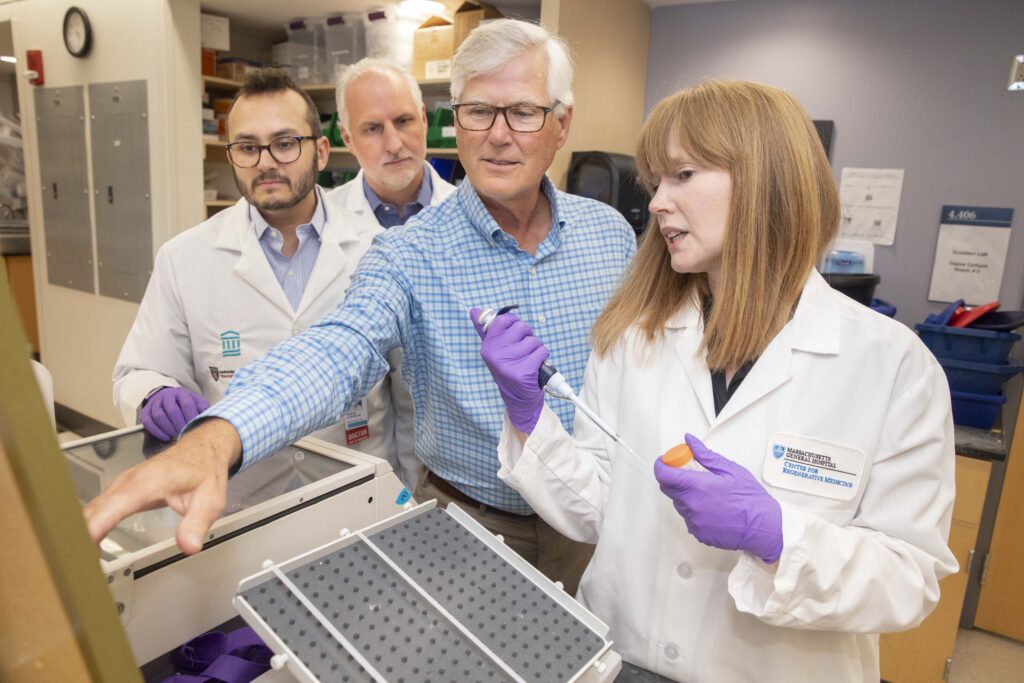

Our commitment to keep you informed is due in large part to your generosity. Donors like you ensure Mass General remains a leader in health care — a world class institution that continues to provide excellent care, train the next generation of medical leaders and conduct groundbreaking research for the betterment of society.

With these new laws in place, your contributions continue to support the hospital’s mission and may enhance the benefits to which you are entitled at a scale never before available and regardless of where you fall on the income ladder.

Support life-saving initiatives at Mass General and reduce your tax bill, all at the same time. Call us at 617.643.2220 or email mghdevpg@mgh.harvard.edu for creative, tax-advantaged gift ideas and techniques.