Catherine Barton Rossetti, JD, recently joined Massachusetts General Hospital as director of the Planned Giving team. As a practicing estate planning attorney, Catherine has worked with all types of clients to provide estate plans that often include charitable bequests. Catherine’s 30-plus years of estate planning and administration experience positions her perfectly to oversee estate gifts to Mass General.

In addition to her work overseeing estate gifts, Catherine also works with Mass General donors to help lay the foundation for future gifts to the hospital. Her unique ability to offer a planned giving perspective considers the need of the donor now, and the legacy they wish to leave in the future.

Leaving your Legacy

While there are many ways to structure your planned gift to Mass General, one popular way is through beneficiary designations. By designating Mass General as a beneficiary of your Individual Retirement Account (IRA) or other qualified retirement plan, donors can make a charitable contribution after their lifetime (while reaping the tax benefits now).

“These are great assets to donate to Mass General not only because they pass free of income tax to the hospital, but once a donor names the hospital as beneficiary, they enjoy peace of mind knowing the asset will pass outside of a lengthy probate process,” says Catherine.

How to Designate Mass General

Simply ask the asset administrator to send you a beneficiary designation form, or complete the form directly on the administrator’s website.

If you participate in an employer-sponsored plan, such as a 401(k), your spouse must be your plan’s primary beneficiary, though your spouse can waive their right in favor of Mass General. Alternatively, with an IRA, you don’t generally need spousal consent to make Mass General the primary beneficiary.

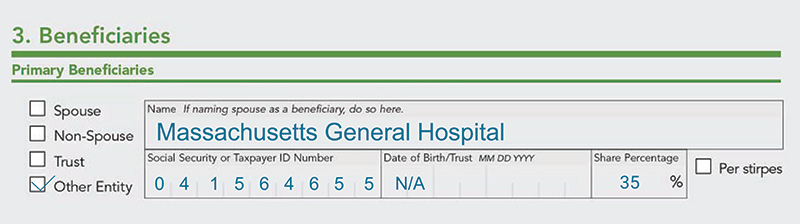

Most forms will ask for your relationship to the beneficiary. As seen in the image below, you would check the box for “Other Entity.” Enter “Massachusetts General Hospital” in the name space. Use Mass General’s tax identification number, which is 04-1564655. And mark the date of birth as N/A.

Other Ways to Give

Beneficiary designations are not the only way to contribute to the success of the hospital through your IRA. A Qualified Charitable Distribution (QCD) from your IRA is a terrific way to make a tax-free donation to Mass General. If you are at least 70½ years old, you may give as much as $105,000 this year from your IRA to your choice of charities.

Whether it’s through a beneficiary designation, QCD or bequest, your gift can have a lasting impact at Mass General. Please contact us with direction on how you would like your gift to be used in a way that aligns with your vision.

“At Mass General, donors are our partners. When we have a direct relationship with donors, we can provide support in decision making and help them achieve their philanthropic goals. This adds a lot of dimension to the gift,” says Catherine.

To learn more about how you can make the most of your IRA and other tax advantageous gifts to support Mass General, please contact the Office of Planned Giving at mghdevpg@mgh.harvard.edu or 617.643.2220.