Unless Congress acts before December 31, 2025, important tax exemptions that have been law for the last eight years will expire when the calendar turns from 2025 to 2026. The “standard deduction” will decrease to pre-2017 levels, potentially encouraging more people to itemize charitable gifts. On the other hand, estate tax exemptions will decrease and return to pre-2017 levels. This means more people at smaller net worth levels could face gift, estate and generation-skipping tax.

What Should You Do in the Face of This Uncertain Future?

- Keep an eye on the values of your home, retirement plan and taxable assets and pay attention to how those values have changed since 2017.

- Reach out to your financial and legal advisors now and begin planning conversations to guard against unexpected surprises.

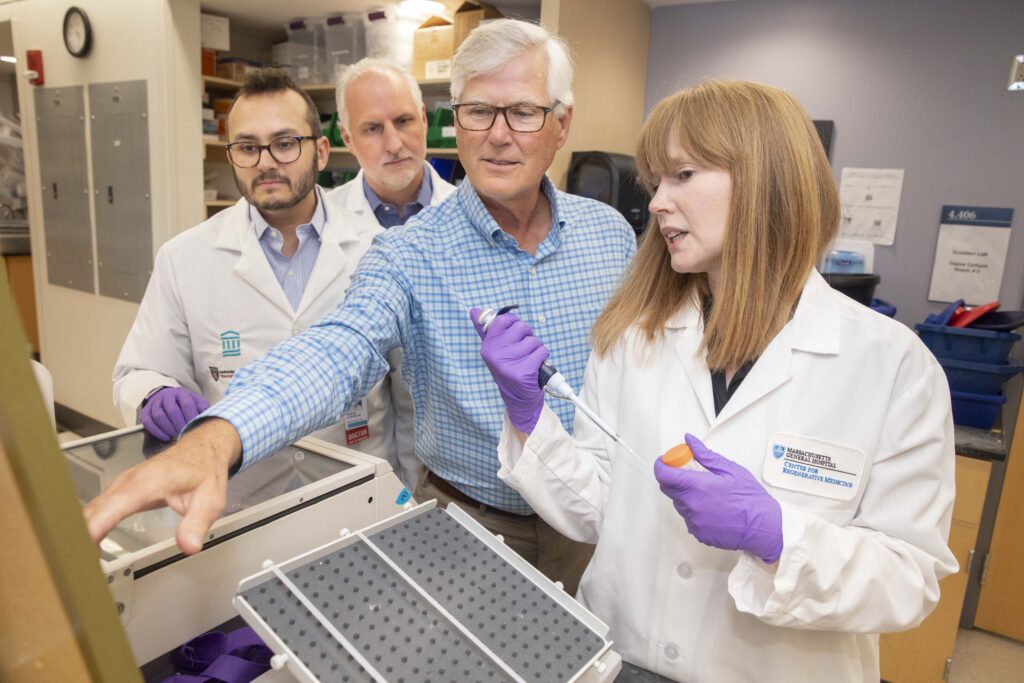

- Remember that planned giving, and including nonprofit institutions like Massachusetts General Hospital, can be a great way to create “win-win” scenarios for you and your family.

To learn more about these potential tax updates and how gift planning can help, please contact the Office of Planned Giving at mghdevpg@mgh.harvard.edu or 617.643.2220.