When discussing charitable gift annuities (CGAs), one could quote the famous 1940s film, Casablanca, by saying, “I think this is the beginning of a beautiful friendship.”

In a successful friendship, two or more parties share a mutually beneficial relationship. The same can be said for CGAs — they are a mutually beneficial relationship between a donor and a charitable organization. With a CGA, the donor makes a special investment through the charitable organization that then provides a fixed amount of money — for life — for the donor, or one or two other individuals that they choose. In turn, the donor’s taxable estate is reduced, and the organization is able to use the investment to advance its mission. A friendship in which all parties benefit.

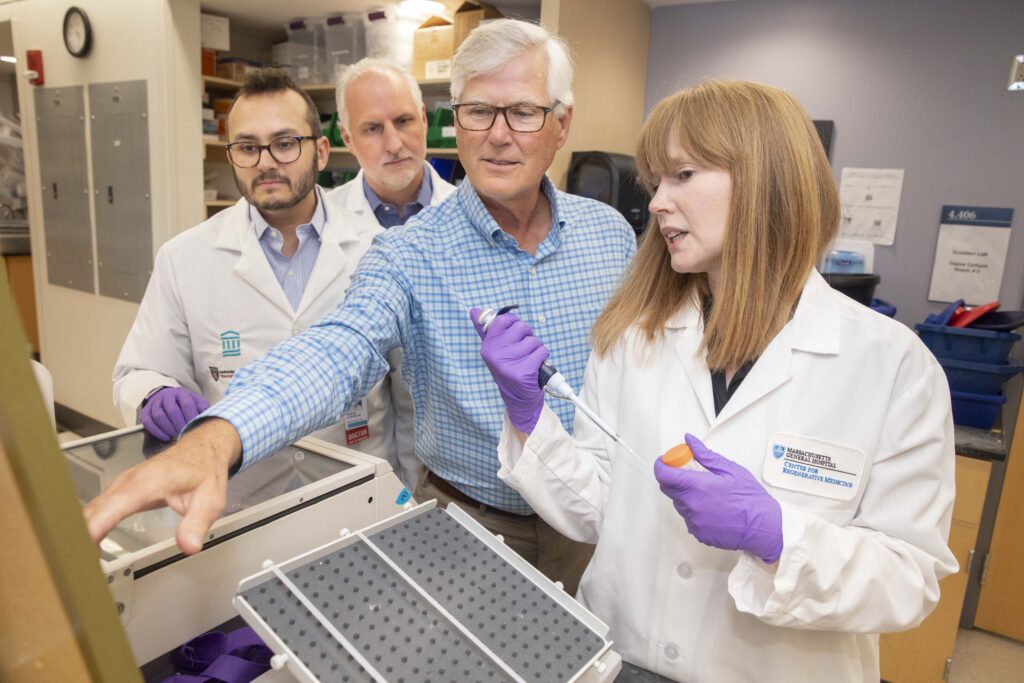

Massachusetts General Hospital has collaborated with many donors to execute their intentions through a charitable gift annuity. In many cases, our donor wanted to provide financial support for an elderly or disabled relative while simultaneously driving important research and medical breakthroughs. But whatever the personal motivation, a well-planned charitable gift affords you the opportunity to do both and receive a current income tax deduction for your agreement.

A Beautiful Friendship: Charitable Gift Annuities

The amount Mass General promises to pay, and the value of your charitable deduction, depend upon the age of the individual and the size and timing of your contribution. For example, you could provide $1,650 per year for the life of a 75-year-old relative in exchange for a contribution of $25,000 and receive an income tax deduction of almost $11,215. Our gift planners would be happy to provide you with an illustration for your unique situation.

These figures are for illustrative purposes only. Your exact benefits will vary based on age, amount and timing of your gift. This information is not legal advice. Please consult with your financial and legal advisors before considering a gift of this nature.

At Mass General, these contributions translate into action. Philanthropic investments like CGAs allow the hospital to harness opportunities to transform the future of health care through programs to address complex issues facing our communities. The needs only grow stronger by the day, particularly on the heels of a global pandemic that proved more work needs to be done, and during a time of unprecedented discovery and innovation in health care.

Similar to the friendship between the two characters portrayed in the famous scene in Casablanca, a CGA partnership is truly unique — they seem improbable, but they work, because all participants are gaining something. There are many reasons why a charitable gift annuity could work for you and your family. And, of course, there may be another gift arrangement that is better suited for you to reach your philanthropic goals. Either way, when you are ready to start “a beautiful friendship” or discuss other tax-smart ways to give to Mass General, we are here to help.

For more information about charitable gift annuities, and to receive your personalized illustration for your giving situation, contact the Office of Planned Giving at 617.643.2220 or mghdevpg@mgh.harvard.edu.

Download our complimentary Estate Planning Guide

For information on how a bequest may benefit you and your family, download our complimentary Estate Planning Guide or contact the Office of Planned Giving at (617) 643-2220.